Unlocking Liquidity and Value: The Power of Asset-Backed Tokens

ICO LAUNCH MALTA

Jay Derenthal

Introduction

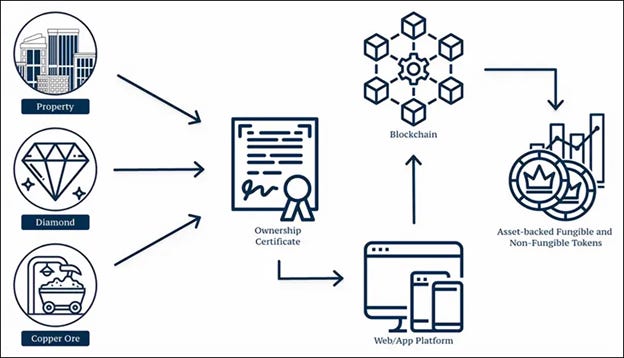

Asset-backed tokens are a groundbreaking application of blockchain technology, holding immense promise in revolutionizing traditional financial instruments. By introducing liquidity and price discovery to previously illiquid markets, these tokens have the potential to unlock trillions of dollars in economic value. This article explores the ability of asset-backed tokens to facilitate cost-effective, fast, and secure trading of real-world assets on the blockchain.

ICO Launch Malta is commissioned to develop several ‘flavors’ of asset-backed tokens, ranging from fund trackers linked to the underlying investment fund’s portfolio to fractional real estate.

The Value of Asset-Backed Tokens

Unlike utility tokens, which lack intrinsic value and often rely on speculative demand, asset-backed tokens derive their value directly from underlying assets. For instance, a token backed by gold, the Euro, or real estate maintains a 1:1 price ratio with the asset it represents. Fiat-backed tokens have fixed value through token exchanges, while precious-metal-backed tokens rely on external “oracles” for price fixing.

Asset-backed tokens offer a logical alternative to speculative utility token investments. By representing tangible assets, they facilitate secure, low-fee trading on the blockchain. Tokenizing assets enhances their liquidity, improves price discovery, reduces volatility, and minimizes the risk of sudden market crashes.

Stablecoins as a Subset of Asset-Backed Tokens

Stablecoins, representing a particular class of asset-backed tokens, provide stability by linking their value to fiat currencies. While stablecoins offer the advantage of price stability, asset-backed tokens encompass a broader range of benefits beyond volatility hedging.

Stablecoins aim to maintain a stable value by pegging themselves to a specific fiat currency or a basket of currencies. This stability makes stablecoins suitable for various use cases, such as facilitating transactions, serving as a medium of exchange, or providing a store of value.

On the other hand, custom asset-backed tokens go beyond stablecoins by enabling the representation of ownership or claim over specific tangible or intangible assets. These tokens can represent assets such as equity and debt instruments, commodities, non-fungible hard assets like real estate or artwork, and non-fungible soft assets like intellectual property or digital collectibles. Asset-backed tokens unlock liquidity, enable fractional ownership, and facilitate the transferability of traditionally illiquid assets.

Opportunities for Asset Owners and Investors

With real-world assets estimated at around $260 trillion globally, asset owners and investors can leverage tokenization to access unprecedented opportunities. Illiquid assets suffering from limited market making and price discovery can benefit from asset-backed tokens. These tokens enable fractional real estate ownership, fund trackers linked to investment portfolios, and various other applications.

Use Cases for Asset Tokenization

Asset-backed tokens are particularly relevant in illiquid markets, including private equity, derivatives, real estate, fine art, investment-grade wines, and other non-fungible assets. By addressing the liquidity and limited commerce challenges associated with these assets, tokenization can unlock their value. Tokenization use cases range from tokenizing corporate equity and debt to fractional ownership of commercial real estate, IP assets, and debt collateralized by payables and receivables.

Equity and Debt Tokenization

Use Cases:

Facilitating crowdfunding for early-stage companies by bypassing traditional intermediaries.

Offering trustless, liquid digital representation of ownership in a company’s equity or debt.

Enabling efficient and transparent trading of fractional equity ownership.

Examples:

Tokenization of a basket of REITs for diversified exposure to real estate cash flows.

Tokenization of commercial real estate equity or rental income to democratize investing.

IP asset tokenization of cash flows from licensing or royalty payments.

Commodities Tokenization

Use Cases:

Tokenizing tradable commodities like oil, natural gas, and agricultural products.

Enabling cross-border trading and enhancing market transparency.

Allowing participation from governments, utilities, and individuals on a single platform.

Examples:

Tokenization of oil, natural gas, and agricultural products for efficient trading.

Tokenization of renewable energy sources (hydro, wind, solar) for sustainable energy trading.

Tokenization of precious metals like gold, ensuring authenticity and quality.

Non-fungible Hard Assets Tokenization

Use Cases:

Increasing liquidity and eliminating intermediaries for traditionally illiquid assets.

Introducing counter-party risk mitigation in asset trading.

Enabling fractional ownership and trading of fine art, investment-grade wines, and derivatives.

Examples:

Tokenization of fine art, allowing fractional ownership and participation in the art market.

Tokenization of investment-grade wines, facilitating trading in the wine market.

Tokenization of derivatives, providing liquidity and transparency in financial instrument trading.

Non-fungible Soft Assets Tokenization

Use Cases:

Enhancing liquidity and value for intellectual property (IP) assets.

Creating scarcity and value in the digital realm for digital collectibles.

Tokenizing multi-pronged cash flows from IP assets like licensing or royalty payments.

Examples:

Tokenization of IP assets, allowing fractional ownership and trading of copyrights, trademarks, patents, and royalty income.

Tokenization of digital collectibles, such as virtual artwork and limited-edition digital content.

Tokenization of cash flows from IP assets, distributing revenue to stakeholders.

Tokenization of Debt Collateralized by Payables and Receivables

Use Cases:

Replacing traditional supply chain financing with tokenization.

Using tokens backed by invoices and payments to streamline financing operations.

Enhancing efficiency and transparency in debt collateralized by payables and receivables.

Examples:

Tokenization of debt collateralized by payables and receivables, replacing factoring in supply chain financing.

Integration of tokens and data flow between accounts payable (AP) and accounts receivable (AR) modules in an ERP system.

Automating the data flow to provide efficiency and transparency in financing operations.

Challenges for Asset-Backed Tokens

While asset-backed tokens offer the advantage of unlocking liquidity, enabling fractional ownership, and facilitating the transferability of traditionally illiquid assets, they also face several challenges that must be addressed for widespread adoption.

One significant challenge is the regulatory landscape surrounding asset-backed tokens. The regulatory environment is evolving, and different jurisdictions apply varying interpretations and regulations. This lack of regulatory clarity challenges issuers, investors, and trading platforms as they navigate compliance requirements and legal obligations.

In addition, user errors can present obstacles in the asset-backed token space. Managing private keys, wallets, and transactions requires technical proficiency and security awareness. Mistakes in handling these elements can result in asset loss or compromise token holdings’ security. Educating users about best practices, providing user-friendly interfaces, and enhancing security measures are crucial to mitigating these risks.

Furthermore, the complexity of navigating different legal frameworks across jurisdictions adds to the challenges faced by asset-backed tokens. Each jurisdiction has its own set of laws and regulations governing securities, commodities, and property rights. The lack of harmonization can complicate cross-border transactions and limit the global reach of asset-backed tokens. Establishing standardized legal frameworks and promoting international collaboration is essential in addressing these challenges.

Despite these obstacles, the potential of asset-backed tokens, including stablecoins, to unlock liquidity, enhance price discovery, and democratize access to investments is significant. By addressing regulatory uncertainties, educating users, and fostering international cooperation, the industry can overcome challenges and create a robust ecosystem for asset-backed tokens. With time, asset-backed tokens, including stablecoins, will become increasingly integrated into the financial system, paving the way for a new era of efficient and inclusive asset ownership and investment opportunities.

Conclusion

Asset-backed tokens have the potential to revolutionize traditional financial instruments by unlocking liquidity, enabling efficient trading, and enhancing price discovery. With applications spanning equity and debt, commodities, non-fungible hard assets, and non-fungible soft assets, asset-backed tokens offer a promising path to unlocking trillions in economic value. As the market evolves, regulators, industry participants, and investors must navigate this landscape carefully and ensure the necessary safeguards are in place.

One of the critical challenges in the widespread adoption of asset-backed tokens is the establishment of robust regulatory frameworks. As this technology disrupts traditional financial systems, regulators must strike a balance between encouraging innovation and protecting investors. Establishing clear guidelines for token issuance, trading platforms, custody solutions, and investor protection will foster trust and confidence in asset-backed tokens.

© 2018 Jay Derenthal, ICO Launch Malta | jay@icomalta.com

Twitter @ICO_Malta

606, Dragonara Business Centre, Dragonara Road

St Julians, STJ 3141, Sliema, Malta

ICO Launch Malta provides tailored ICO and STO solutions to startups and established companies seeking funding and exchange listings.

Our in-house blockchain developers specialize in creating cryptographic equivalents of traditional financial instruments.

Our marketing team excels at below-the-line marketing and crafting compelling narratives to optimize fundraising outcomes.

Our expertise extends to tokenizing various assets, including art collections, fractional real estate projects, asset-backed offerings, investment funds, and blockchain bonds.

We ensure compliance by operating from Malta, an EU and Eurozone member, with favorable regulations.

We prioritize stringent KYC and AML verification on our ICO platform, which includes sanction and watchlist checks to ensure compliance and security.

Through our partnerships with licensed corporate service providers, we offer assistance with company incorporation, legal reviews, token sale agreements, and ICO-related legal and tax advice.